Is Your 401k Ripping You Off? |

|

Fees can take a big bite out of your nest egg. Learn how to pick the right investment vehicle and avoid excessive charges. |

|||||||||||||||

|

You would, of course, be insane to accept such a deal. Yet that's essentially what's been happening with your 401k for years. The companies that administer 401ks have been so good about obscuring costs that 71% of workers polled for AARP believed that they didn't pay any fees for their plans. (Someday, investors may learn there's no such thing as a free lunch, but probably not in my lifetime.) Why Fees MatterHere's a hypothetical example of how higher fees can reduce a 401k balance over a working lifetime. The example assumes that the worker contributes $5,000 a year for 40 years and that the underlying investments return a 7% average annual return.

Review the following case study of a typical 401k vs a superior alternative Here. What's worse, a lot of employers don't know how much their workers are paying. For example: Investment management fees make up the bulk of total 401k expenses, according to a study issued by the Government Accountability Office. Yet half of the employers the GAO surveyed either didn't know if they or their workers paid investment management fees, or they thought that such fees were waived. That's a problem, because by federal law employers are supposed to pay attention to costs. Companies that sponsor 401k plans have a fiduciary duty under the Employee Retirement Income Security Act to make sure the plan's fees and expenses are reasonable. The GAO put some of the blame on the investment companies that administer 401ks, saying their disclosures "can be very complicated and difficult to understand, which could reduce their usefulness to plan sponsors." Enter the U.S. Department of Labor, which finally decided enough is enough. The government is demanding that investment companies provide clearer breakdowns to employers, and that employers pass that information along to you. The investment companies were required to make the disclosures to employers by July 1. By Aug. 30, you're supposed to have the information in your hot little hands. If your employer misses that deadline, you should at least get the cost figures when your third-quarter statement is mailed out after Sept. 30. You'll get yearly cost summaries after that.

These disclosures aren't personalized. You won't be told how much your individual account is actually being charged, for example. But for the first time you'll have a big-picture view of your plan's costs. But how will you know if the fees you're being charged are reasonable or outrageous? It's actually your employer's job to figure that out (remember that fiduciary duty stuff?). The Department of Labor is hoping all this disclosure prompts more employers to shop more carefully for their 401k plans; more comparison shopping should -- in theory -- result in lower costs. But your employer may need a little push, especially if you work for a small company. Plans with less than $1 million tended to have the highest fees, according to a study by Deloitte and the Investment Company Institute. If you work for a large employer -- as most 401k contributors do -- you probably have a pretty good plan. Participants in big plans often have access to lower-cost options than are available to investors outside the plans, said David Wray, the president of the Plan Sponsor Council of America. Large companies have the people and the financial clout to negotiate a better deal, said Bill Harris, the CEO of Personal Capital, an online financial adviser that plans to launch a low-cost 401k plan for small and mid-size businesses. "At smaller companies, the owners . . . are busy with other things," Harris said. "The owner might say, 'I need a 401k. OK, let's talk to my insurance guy.' " Insurers are often more willing than big mutual fund companies to take on small accounts. Unfortunately, insurers typically offer more expensive investment options. Participants in small plans also can wind up paying proportionately more for various account services, since the costs are spread over fewer people. One way to see if your plan's fees are reasonable is to look up your company on BrightScope, a financial information company that offers retirement plan ratings. (The site may not have a rating for small plans, however, because of lack of data.) If you register, you also can get a free "personal fee report" that summarizes what you're paying for your investments.

|

||||||||||||||||

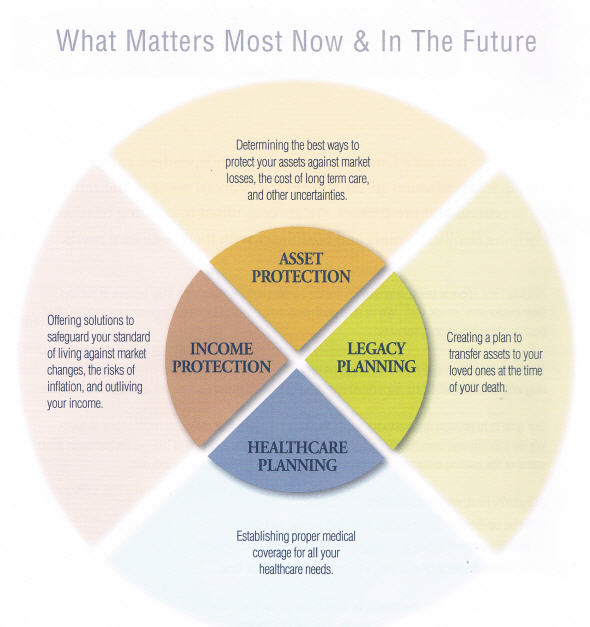

Call us now at (954) 781-2220 or fill out this short survey to find out more about how you might receive guaranteed* income for life and protect your principal at the same time!

** New ** 8 hour Workshop: Conservative Investing Techniques In Our Current Environment. Cl'ck here for details. Cli'ck Here to Get Your FREE gift that will help you plan for long-term care expenses. and your income for life illustration. Go To SMARTMONEY Newsletter Archives Website: www.StatewideRetirementPlanning.com

Review our Highly Acclaimed Videos: Review our 10-minute video “Paycheck For Life” Statewide Retirement Planning Co. |

||||||||||||||||